The Harsh Reality of Owned Media: SMS Will Make You Money… and Enemies

Why high-converting SMS campaigns come with higher unsubscribe rates—and exactly how to run them without burning your list.

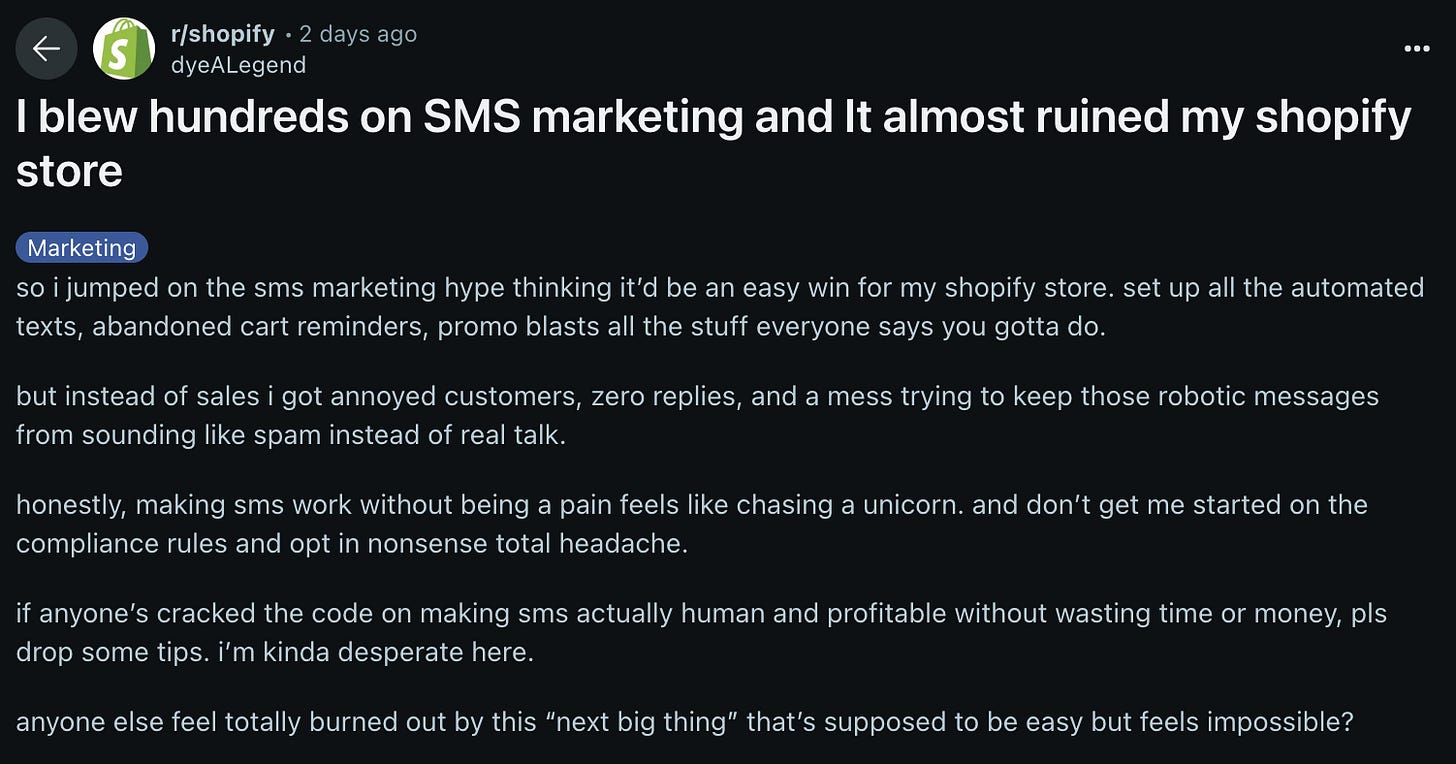

https://www.reddit.com/r/shopify/comments/1mm4wju/i_blew_hundreds_on_sms_marketing_and_it_almost/

Owned channels like SMS and push notifications can be game changers for revenue. But they come with a cost. They will irritate people. They will cause unsubscribes. And if you do it wrong, they will damage your brand.

I’ve lived this. When I went from one push notification a day to six, revenue tripled overnight. That sounds like a win, but the unsubscribes spiked too. The lesson? Growth in owned media is never free.

The trick is knowing your limits, tracking the right metrics, and putting structure around your program so you can scale without burning your list. That’s what this guide is for.

Step 1: Define the rules

Every SMS program needs clear rules from day one.

Pick one goal. Do you want more new orders? Repeat orders? Higher average order value? A growing list? Reviews and user content? Pick one and align every decision to it. Without a north star, your program will drift.

Set guardrails. Decide how often you will send, when you will be silent, and how you’ll measure annoyance. For example: a maximum of two sends per week, quiet hours at night, and unsubscribes under 1% per send. These rules protect your list and your brand.

Define your KPI. Choose the single metric that represents success. Revenue per message, conversion rate, unsub rate, or net list growth. Whatever you pick, track it relentlessly and judge all experiments against it.

Step 2: Get compliant

Compliance is not fun, but it is the foundation.

Consent is non-negotiable. Capture explicit opt-ins through checkout boxes, popups, or keywords. Store the timestamp and the source so you can prove it.

Identify yourself. Every message should include your brand and a clear STOP command. This builds trust and keeps you safe.

Respect quiet hours. Nobody wants a text at midnight.

Follow the law. In the US, register with 10DLC or toll-free verification. In Canada, follow CASL: express consent, clear identification, and simple opt-out.

Step 3: Connect your stack

Data is the fuel.

Inputs. Feed your SMS tool with customer data, order history, and behavioral events like viewed, added to cart, and checkout started. This is what powers personalization.

Outputs. Track every click with UTM tags and send it into your analytics. Build a dashboard to monitor sends, clicks, orders, and unsubscribes. Even a Google Sheet will work. Without this loop, you are flying blind.

Step 4: Acquire high-intent subscribers

Not all opt-ins are equal. Go for quality.

Checkout opt-ins. This is the best place to capture people who are already engaged. Set the expectation: “Get order updates and early access.”

On-site popups. Incentives like 10% off or first access to drops work well. Always collect email and SMS together so you can build both channels.

Post-purchase invites. Ask people to join after they buy. Position it as membership: “Restocks and members-only drops.”

Step 5: Launch a Welcome Flow

The welcome flow is where you train your new subscribers.

Message 1 (immediate). Thank them, deliver a code or link, and remind them how to opt out.

Message 2 (day 2–3). Share something useful like a tip or mini guide. This shows you aren’t only here to sell.

Message 3 (day 5–7). Introduce scarcity with a time-sensitive offer or early access. Now you’ve earned the right to sell.

Step 6: Turn on the 5 money flows

Automation beats blasts. Always.

Abandoned Cart. Send a reminder 30–90 minutes after abandonment, then again 20–24 hours later with social proof or low stock urgency.

Browse Abandon. Catch window shoppers with a note like “Still thinking about {Product}? Here’s how it fits…”

Post-Purchase. Confirm the order, share care tips, and then cross-sell after 7 or 30 days.

Win-Back. At 45–90 days of inactivity, send “We miss you” with something new or a discount code.

Review/UCG. After 7–14 days, ask for a rating or photo review. Sweeten it with a perk.

Step 7: Broadcast cadence

Blasts should be the exception, not the rule.

Start slow. One per week, max two.

Ramp carefully. Increase only if revenue per message climbs and unsubscribes stay low.

Balance the content. Half should be value (tips, restocks, early access). The other half can be offers.

Step 8: Minimum viable segmentation

Segmentation makes messages feel relevant. Start with just a few.

VIPs. Two or more orders or above-median lifetime value. Reward them with exclusives.

Coupon lovers. Target them with promotions and bundles.

Full-price buyers. Focus on quality and experience, not discounts.

Category fans. If someone buys in one category, show them new items there.

Dormant users. No clicks in 60 days? Snooze them or run a re-permission campaign.

Step 9: Write texts humans like

Copy makes or breaks SMS.

One job per text. Click or reply, not both.

Keep it tight. 130–160 characters, plain language, first name if you have it.

Use urgency and proof. “Back today: {Bestseller} in {Color}. Last run sold out in 6h.”

Avoid gimmicks. Shouting SALE with 10 emojis kills trust.

Step 10: Test weekly

Small tests compound into big wins.

Try offer vs no offer.

Morning vs evening.

Short copy vs long.

Emoji vs none.

Product A vs Product B.

Call winners by revenue per message, then conversion rate, then unsub rate. Lock in, move on.

Step 11: Attribute properly

Don’t let SMS steal credit or get ignored.

Tag every link with UTMs.

Count “assists” where SMS drove the click but the purchase came later.

Watch sends, clicks, orders, CVR, RPM, unsub %, complaints, and net list growth.

Run the math:

RPM = Revenue ÷ Messages Sent

ROI% = (Revenue – Discounts – SMS Cost – Ops Costs) ÷ SMS Cost

Step 12: Frequency and friction controls

Protect your list.

Add a kill switch: pause if unsub >2% or complaints spike.

Snooze anyone inactive for 60 days.

Send “Still want texts?” check-ins.

Always honor STOP instantly.

Step 13: Scale without torching the list

Growth comes from discipline.

Offer text-only perks like early links and surprise drops.

Coordinate with email and push. Don’t triple-ping people in one hour.

Clean your list often. Remove hard bounces and keep carrier trust high.

Step 14: 30-day launch plan

Week 1. Get compliant. Turn on opt-ins, Welcome, and Abandoned Cart.

Week 2. Add Post-Purchase, Reviews, and your first VIP broadcast.

Week 3. Add Browse Abandon, Win-Back, and a second broadcast.

Week 4. Tune the winners, adjust frequency, and publish your first SMS report.

Benchmarks: What “Good” Looks Like

SMS conversion rate. 21–30% overall. 11–20% in ecommerce. Higher in tech.

Push CTR. 2–5% on average. Android usually higher than iOS.

Email CTR. 1.7–2.0% with opens in the 30–40% range. Automations like cart, welcome, and browse flows deliver most of the orders.

Takeaway: SMS usually wins on conversion, push wins on speed, and email wins long-term. Ignore vendor averages. Focus on your own RPM, unsubscribes, and list growth.

Free Templates (steal these)

Abandoned Cart

“{First}, you left {Product}. Want us to hold it for an hour? Finish here: {link} –{Brand} (Reply STOP to opt out)”

Back in Stock

“It’s back: {Product} in {Color}. Last run sold out in 6h. Early link: {link} –{Brand}”

Win-Back

“We saved you 10% on your next {Category}—valid 48h. Code: BACKAGAIN → {link} –{Brand}”

Value Tip

“Pro tip for {Product}: {1-line care/use hack}. Full guide: {link} –{Brand}”

Conclusion

SMS is powerful because it cuts straight through the noise. But that power is easy to abuse. If you treat it like a firehose, you’ll burn your list and your brand. If you treat it with respect, you’ll build a reliable revenue stream that complements your email and push programs.

Start small, follow the rules, track the right numbers, and scale carefully. The brands that win with SMS are the ones that think long-term.Free templates (steal these)

Sources:

https://www.reddit.com/r/shopify/comments/1mm4wju/i_blew_hundreds_on_sms_marketing_and_it_almost/

https://simpletexting.com/sms-marketing/benchmarks/conversion-rates-cvr/?utm_source=chatgpt.com

https://clevertap.com/blog/push-notification-metrics-ctr-open-rate/

https://www.businessofapps.com/marketplace/push-notifications/research/push-notifications-statistics/

https://www.airship.com/blog/a-marketers-guide-to-push-notification-benchmarks/

https://mailchimp.com/resources/email-marketing-benchmarks/

https://www.mailerlite.com/blog/compare-your-email-performance-metrics-industry-benchmarks

https://www.omnisend.com/2025-ecommerce-marketing-report/